What is the Corporate Transparency Act? The Corporate Transparency Act (“CTA”), effective January 1, 2024, is part of the federal government’s war on financial crimes, like tax fraud, money laundering, terrorism financing and drug trafficking. Every domestic entity formed by a filing with a Secretary of State (or equivalent), and every foreign entity that is registered to do business in a state, must determine whether it is subject to the CTA and its reporting requirements. Effectively, this means that the CTA applies to all corporations, limited liability companies and limited partnerships (and in DE, LA and HI, general partnerships) and possibly other entities formed in the U.S., and to all foreign entities registered to do business in the U.S.

What does the CTA require? Domestic and foreign entities subject to the CTA (“Reporting Companies”) must file a Beneficial Ownership Information Report (“BOI Report”) with the Treasury Department’s Financial Crimes Enforcement Network (“FinCEN”) disclosing information about the Reporting Company and about the owners and management of the Reporting Company. It is important to consult FinCEN’s regulations and guidance carefully when determining who must be identified in a BOI Report as an “owner” and as a member of management exercising “substantial control” over the Reporting Company. Owners and control persons must provide their personal information to FinCEN and remain in its database indefinitely.

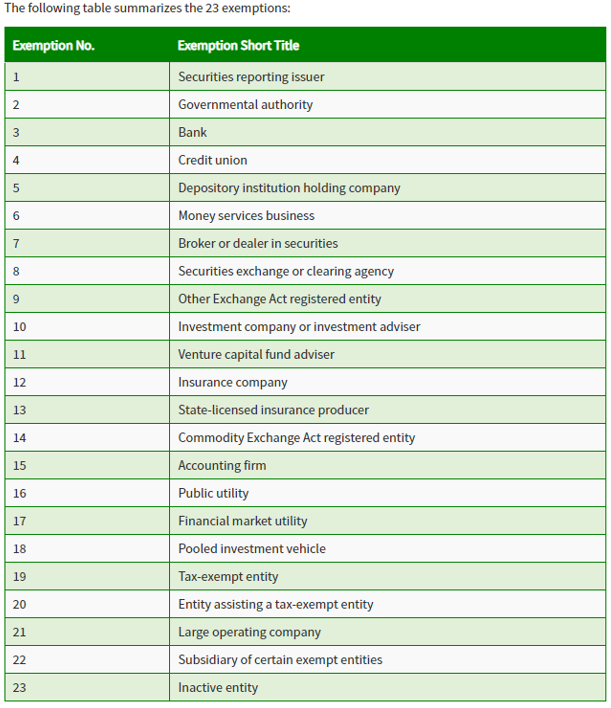

How can I determine if my entity is exempt? There are 23 exemptions under the CTA. Most of the exemptions apply to large entities that are highly regulated and already subject to similar reporting requirements, but there are also exemptions for certain tax-exempt entities and large operating companies that aren’t necessarily subject to regulation. A table summarizing the exemptions is set forth below. It is expected that most of the Reporting Companies will be small to medium-sized businesses. FinCEN estimates that in 2024 alone roughly 33 million entities will have to file BOI Reports and each year thereafter, perhaps five million newly formed or registered entities per year will become Reporting Companies.

What do I have to do if I am not exempt? If the Reporting Company was formed or registered before January 1, 2024, the Reporting Company has until January 1, 2025 to file a BOI Report. A Reporting Company formed or registered on or after January 1, 2024 must file its BOI Report within 90 days of its formation. Reporting Companies must update their BOI Report information within 30 days of any changes so it is important for Reporting Companies to be aware of when information must be updated.

What are the consequences of not complying with the CTA? The CTA provides for civil penalties ($500/day) and criminal penalties (two years imprisonment and up to $10,000 fine) for willful failure to comply with the CTA. There are also penalties for willfully providing false or fraudulent information in a BOI Report.

How do I begin the process of complying with the CTA? FinCEN’s website has helpful guides and other information about compliance with the CTA. Owners and officers of entities formed by a filing or registration with a state agency should begin the process of determining eligibility for an exemption and any requirements to file a BOI Report. The Corporate Department of Keesal Young & Logan is available to advise clients about their eligibility for exemptions and to assist in complying with the CTA.

Exemptions under the Corporate Transparency Act

This table sets forth the titles of the exemptions under the CTA. It is provided only as a summary. The determination of a company’s eligibility for an exemption should be made only after consulting the requirements for each exemption set forth in applicable law, regulations and other official interpretive guidance.

CAUTION: FinCEN has issued an alert warning of recent fraudulent attempts to solicit information from individuals and entities who may be subject to reporting requirements under the CTA. Be careful of email and other solicitations from unknown sources, some posing as FinCEN, which may contain links, QR codes or unsolicited requests for information. Provide personal and confidential information only to vetted and trusted sources.

Keesal Young & Logan Corporate Department

Sandor X. Mayuga

Partner

Long Beach

(562) 436-2000

sandor.mayuga@kyl.com

Ailan Liu

Associate

Long Beach

(562) 436-2000

ailan.liu@kyl.com